Table of Contents

Tesla’s Q1: Tesla’s Commitment to Affordable EVs Ignites 13% Stock Surge Despite Q1 Profit Plunge

In the tumultuous landscape of Tesla’s first quarter, characterized by a sharp decline in profits and a dip in revenue, a ray of hope emerged with CEO Elon Musk’s resolute commitment to ushering in a new era of affordability in electric vehicles (EVs). Despite reporting a staggering 55% drop in net profit to $1.13 billion and a 9% fall in revenue, the announcement of forthcoming ‘more affordable’ EV models sparked a remarkable rally in Tesla’s shares. Musk’s unwavering pledge to accelerate the launch timeline, aiming for early 2025 if not late 2024, ignited investor optimism and drove Tesla’s stock price up by a staggering 13% in after-hours trading. This surge reflects the market’s fervent belief in Tesla’s ability to innovate and disrupt the automotive industry once again. As the company charts its course towards democratizing EV ownership, Musk’s visionary leadership and bold promises serve as beacons of hope, propelling Tesla into a future where sustainability meets accessibility. Amidst the backdrop of financial challenges, Tesla’s Q1 results underscore a narrative of resilience and determination, fueled by a relentless pursuit of progress and a commitment to realizing Musk’s ambitious vision for the future of transportation.

Tesla (TSLA) unveiled its first-quarter financial results, disappointing with a significant drop in earnings and revenue, marking its lowest EPS since 2021. Despite this, TSLA stock surged after-hours, buoyed by the promise of forthcoming “more affordable” models.

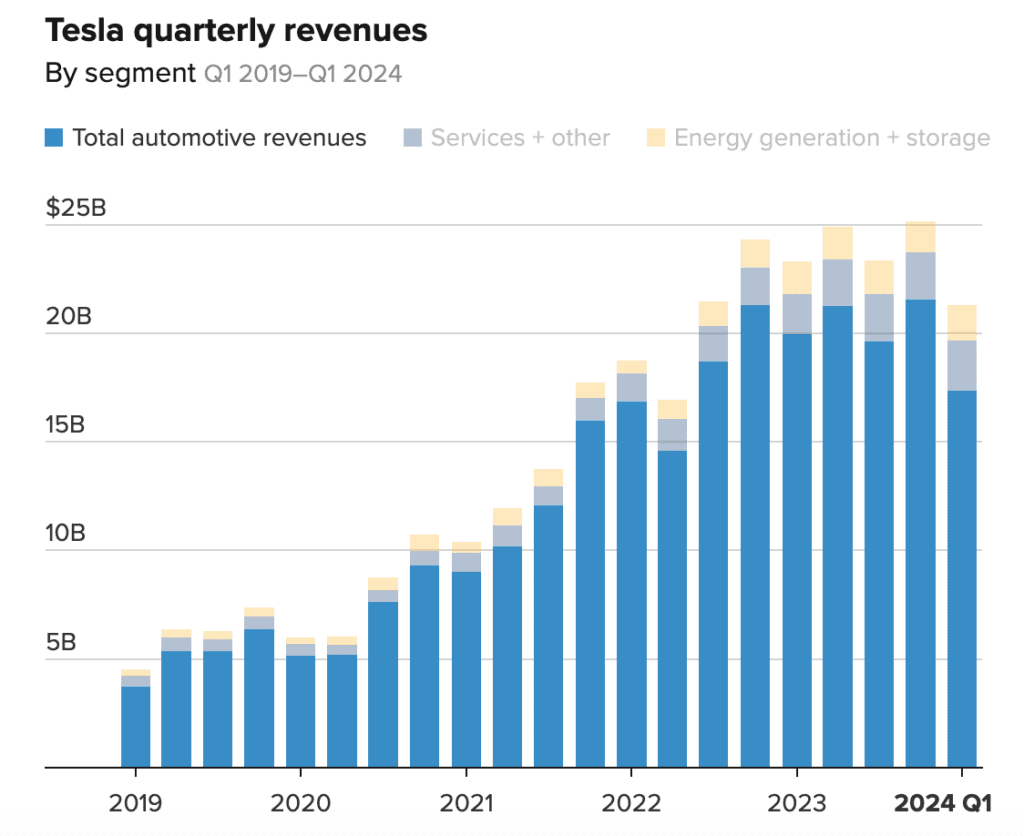

In Q1, the electric vehicle (EV) giant reported a substantial 47% decline in earnings, down to 45 cents per share, alongside a notable 9% reduction in revenue, amounting to $21.3 billion compared to Q1 2023. Analysts’ forecasts had suggested a less severe earnings dip of 42% to 49 cents per share, with sales expected to decrease to $22.22 billion, indicating a slight variance from Tesla’s actual financial performance.

Despite Q1’s EPS hitting its lowest since Q1 2021, Tesla unveiled its next-generation platform currently in development. Tesla is confident that this platform will drive growth by leveraging autonomy advancements and introducing innovative new products to the market.

Tesla pledged to expedite the launch of new models ahead of the initially scheduled start in the second half of 2025. These new vehicles, labeled “more affordable” by Tesla, will integrate features from both the next-generation platform and existing platforms, streamlining production alongside current models.

Elon Musk, Tesla’s CEO, disclosed intentions for the forthcoming model line to hit the market as early as 2025, potentially advancing to late 2024. Moreover, Tesla tantalized investors with news of an impending reveal of its robotaxi, or “cybercab,” scheduled for August 8, promising deeper insights into the low-cost vehicle’s features.

The decline in revenue primarily attributed to reduced vehicle selling prices and delivery constraints, particularly related to the Model 3 refresh rollout. Despite this setback, Tesla remains optimistic about its energy storage deployments and revenue from energy generation, projected to outpace automotive business growth in 2024.

In Q1, Tesla experienced a negative turn in free cash flow due to factors such as inventory accumulation and substantial investments in AI infrastructure. Despite this setback, the company is optimistic about a rebound in Q2, aiming to achieve positive cash flow. Concurrently, Tesla remains focused on expanding its AI infrastructure capabilities and advancing its ride-hailing services, signaling a commitment to innovation and growth in its operational endeavors.

Despite facing challenges, Tesla’s stock experienced a significant surge of over 10% during after-hours trading. This uptick was driven by investor optimism stemming from Tesla’s promise to expedite the launch of electric vehicle models and streamline production. The commitment to offering more affordable EVs resonated positively, mitigating concerns over weak deliveries and competitive pressures in the market.

Despite facing headwinds such as slowing EV sales growth and ongoing price cuts, Tesla remains resilient in its pursuit of innovation and market expansion. The company’s strategic initiatives, including the introduction of new models and advancements in autonomy, underscore its commitment to long-term growth and sustainability in the EV landscape.

Tesla’s Q1 earnings call: In dissecting Elon Musk’s remarks during Tesla’s Q1 earnings call, several key takeaways emerge, shedding light on the company’s trajectory and strategic focus. Firstly, Musk’s emphasis on accelerating the launch of more affordable EV models signals Tesla’s commitment to broadening accessibility within the electric vehicle market. This strategic move not only aligns with Tesla’s mission of sustainable transportation but also reflects a proactive approach to addressing market demands. Secondly, Musk’s reaffirmation of Tesla’s advancements in autonomy and the introduction of new products underscores the company’s relentless pursuit of innovation. By leveraging next-generation platforms and AI infrastructure, Tesla aims to drive growth and maintain its competitive edge in the rapidly evolving automotive landscape. Thirdly, Musk’s candid acknowledgment of operational challenges, such as supply chain disruptions, provides transparency into Tesla’s operational hurdles and its proactive stance in overcoming them. Lastly, Musk’s unwavering confidence in Tesla’s long-term vision, despite short-term setbacks, instills optimism among investors and stakeholders, reaffirming Tesla’s position as a pioneering force in the EV industry. These key insights gleaned from Musk’s commentary offer valuable perspectives for understanding Tesla’s Q1 performance and its strategic direction moving forward.